Issue 20 (Spring 2023), pp. 37-87

DOI: 10.6667/interface.20.2023.193

Innovation in Pricing Mechanisms: An Analysis of the Emergence of Fixed and Dynamic Pricing in Five Countries

| Karl Akbari |

| National Taiwan University of Science and Technology |

Abstract

This study examines how two pricing innovations, fixed and dynamic pricing, became the modi operandi in pricing. We first introduce the historical context and adoption of fixed and dynamic pricing mechanisms and identify common themes and differences. In addition, the innovation patterns of the fixed and dynamic prices in five countries, Japan, Britain, France, the United States, and China, are analyzed and contextualized from a historical, biographic, and a buyer/seller perspective. The results show that fixed and dynamic pricing have continuously evolved and gained widespread acceptance as a leading pricing strategy once the appropriate platform was available (e.g., department stores for fixed pricing or a deregulated airline industry/e-commerce for dynamic pricing). The key factors contributing to the diffusion of pricing innovations: mutual benefits for buyers and sellers, competitive pressure for smaller sellers to adopt the innovative pricing mechanism, and market expansion by including less affluent customer groups, are guidelines for the success of future pricing innovations.

Keywords: fixed pricing, dynamic pricing, innovation, business history

Innovation is a multi-faceted concept that plays a vital role in driving economic growth and progress.[1] According to the economist Joseph Schumpeter, innovation disrupts existing market structures and creates new ones, thereby driving economic development (Schumpeter, 1942). The concept of innovation emerged in the early and mid-20th century, and its study provides valuable insights into the workings of our world today (Popplow, 2021).

Thompson (1965) defines innovation as the “generation, acceptance, and implementation of new ideas, processes, products, or services.” Innovation can take many forms, and its impact can range from progress and growth to friction and social imbalances. This study focuses on an inconspicuous type of innovation, but one with major consequences, on pricing mechanisms innovations, specifically fixed pricing and dynamic pricing in business-to-customer markets.

For businesses, pricing is a critical factor that determines financial success. The right pricing strategy can increase profits, improve market positioning, and enhance customer loyalty. Conversely, incorrect pricing can result in reduced sales and decreased profits. For consumers, prices carry a deep meaning, influencing their perceptions of fairness, trust in the seller, and the perceived value of the transaction.

Innovation does not occur naturally and should not be considered a law of nature. Therefore, this study aims to understand the historical context and adoption of fixed and dynamic pricing mechanisms and identify common themes and differences. Thus, we aim to explain how fixed and dynamic prices have become the modi operandi in pricing today. The study also aims to evaluate the relevance of these innovations for emerging pricing mechanisms. Despite the significance of pricing innovation, it has received relatively limited research attention, particularly its historical context, adoption process, and cross-cultural significance. This study seeks to fill this gap in the literature.

The paper is structured into three parts. Firstly, the historical background of fixed and dynamic pricing mechanisms will be introduced. Secondly, the innovation adoption will be analyzed and contextualized from historical, biographic, and buyer/seller perspectives. Finally, we conclude.

1 Pricing innovations

In most parts of the world, consumers are accustomed to two prevalent pricing mechanisms. When purchasing goods or services from brick-and-mortar stores, consumers typically encounter a single, fixed price established by the seller, which is relatively stable over time and consistent for all buyers. When purchasing goods or services online, consumers will be presented with a price on the website. This price may fluctuate based on the time of purchase. This pricing model, dynamic pricing, is typically implemented through computer algorithms to set prices.

These pricing models are relatively recent developments in the history of pricing. Historically, prices were not solely determined by the seller but were negotiated through bargaining for most products in most regions of the world. Until the mid-19th century, bargaining was the primary pricing model, after which fixed prices became dominant. Only in the late 20th century did the dynamic pricing model emerge and become widely recognized. We will examine these two pricing mechanisms’ innovation histories in the following.

1.1 Fixed pricing

Fixed pricing, also referred to as a one-price policy (Grinder & Cooper, 2022; Norris, 1962; Shiozawa et al., 2019; Vaccaro & Coward, 1993), uniform price (Tirole, 1988), or fixed offer prices (Gudehus, 2007), is a pricing mechanism in which the seller sets a price that the buyer cannot influence. The price is communicated to the buyer, who can then decide whether to purchase or not (take-it-or-leave-it offer).

It is crucial to note that a fundamental aspect of the definition of fixed price is that the seller has complete control over determining the price. This eliminates another type of fixed price, where the price is the same for all buyers and sellers but is instead set by a third party, such as the government or guilds (Ogilvie, 2014). For example, King Edward III established fixed prices for wool in 1337, which allowed him to purchase the commodity at a lower cost within England and then sell it at fluctuating prices to weavers in other parts of Europe (Casson & Casson, 2014). Although this price is also “fixed,” it is not the innovation discussed here. Furthermore, fixed prices are usually stable for a certain period but not indefinitely. Promotional discounts, such as end-of-season sales or off-peak pricing and general price adjustments made in response to cost or profit margin changes, do not conflict with a fixed pricing strategy.

The development of the fixed price innovation is a subject of interest, and this study aims to examine the innovation patterns of the fixed price in five countries: Japan, Britain, France, the United States, and China. Fixed prices have existed in some form, such as in taverns during ancient Egyptian and Roman times (Casson, 1974) or in pubs in the 18th century (McKendrick et al., 1982), but they were peripheral phenomena. This study will examine how they became the dominant pricing strategy.

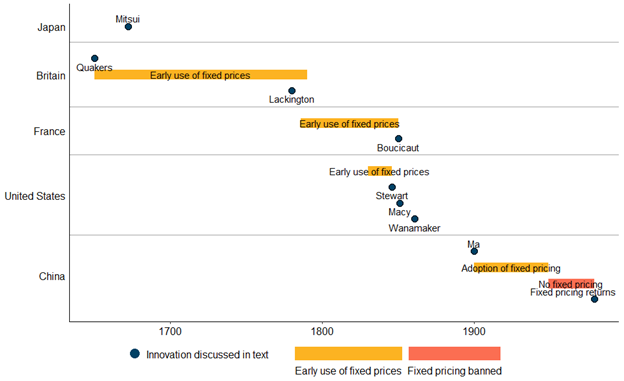

Anecdotal evidence suggests that specific individuals may be credited as innovators of fixed pricing in the five countries studied. These potential candidates include (in chronological order) Mitsui Takatoshi in Japan, James Lackington in Great Britain, Astride Boucicaut in France, Alexander Turney Stewart, Rowland Hussey Macy, and John Wanamaker in the United States, and Ma Yingbiao in China. Figure 1 shows a timeline for the adoption of fixed pricing. The following paragraphs will examine the historical evidence of the emergence of the fixed price and provide insight into the stories of these potential innovators.

Figure 1: A timeline of the fixed pricing innovation

1.1.1 Japan

In ancient Japan, the samurai culture viewed setting high prices and focusing on profit as immoral (Tsunoda et al., 1958). However, as the economy transformed in the 16th and early 17th centuries, the previously low-status merchant class began to rise and establish new norms. In traditional markets and shops, haggling with customers over prices became common. Merchants could trade and sell goods nationwide, open new stores, and sell various product classes. Their business practices were characterized by a proliferation of selfish, illegal, and shady business practices, which were tacitly condoned by government officials who accepted bribes in exchange for their complicity (Yamamura, 1973).

The practice of fixed pricing in Japan has a historical origin that can be traced back to the 17th century. Japan’s earliest known mention of fixed pricing dates back to 1672 (Yonekura & Shimizu, 2010), 1673 (Horide, 2000; Russell, 1939), or 1683 (Shiozawa et al., 2019). The individual credited with the introduction of this innovation is Mitsui Takatoshi (三井高利, 1622-1694). Mitsui came from a middle-class merchant family. His mother, Shuho (殊法), was the family head and a devout Buddhist and educated her children in this spirit. Their philosophy is based on the principle of Ji-Hi (慈悲), which embodies the virtue of compassion of the Buddha. This Buddhist philosophy has two elements: Ji (慈), which entails giving happiness to all living things through friendliness, benevolence, and goodwill, and Hi (悲), which involves freeing all living things from torment and distress. Following Buddhist faith, one should excel in one’s profession. For merchants, these teachings dictate that they should strive to excel by making as much profit as possible, while being honest, respected, and beneficial to the country. Poverty is not desirable, but selfishness and pursuing one’s own gain at the expense of others are considered wrong (Basu & Miroshnik, 2021b; Horide, 2011; Nakamura, 1967).

Mitsui followed these beliefs and was well known for his rigorous work ethic, diligence, honesty, and frugality (Horide, 2011, 2019). As the fourth son, Mitsui spent most of his life working under his older brother in the family’s retail business. After his brother passed away, Mitsui, at the age of 50, established the Echigoya Drapery (越後屋), a kimono shop in Surugashu. Upon opening, he announced non-negotiable and fixed prices (Horide, 2000; Russell, 1939; Shiozawa et al., 2019).

This change in pricing strategy came with other innovations. On the one hand, Mitsui did not provide credit, nor did he conduct home visits, a common practice among his competitors. On the other hand, his prices were lower than those of his competitors. Additionally, while other sellers focused on offering highly customized services to the elite, negotiated prices, and extended credit limits, Mitsui’s fixed pricing strategy allowed him to successfully target the middle class, allowing his business to grow and expand to other product sectors and become very wealthy (Yamamura, 1973). On top of that, Mitsui’s descendants build one of Japan’s most significant business empires. As a result, the Echigoya Drapery eventually evolved into what is now known as department stores and the Mitsukoshi retail shopping chain (Shiozawa et al., 2019; Yonekura & Shimizu, 2010).

Fixed prices did not immediately become the primary pricing method. In the early and middle Edo period (1603-1800), merchants continued to pay suppliers as little as possible and charge buyers as much as possible (Jansen, 2000; Ramseyer, 1979). Moreover, Mitsui’s innovations in discount selling angered competitors, leading to exclusion from the guild and acts of sabotage, such as building a toilet to overflow onto the store or threats to attack and set the store on fire (Horide, 2000). Eventually, however, other merchants followed Mitsui and adopted fixed pricing. By the early 19th century, this practice had become a standard among merchants in Japan. Furthermore, merchants prided themselves on “charg[ing] the standard market price for an article, and not add[ing] an unfair profit to the price” (Ramseyer, 1979, p. 213).

From the 1630s to 1853, Japan was mostly isolated from the rest of the world. Japanese citizens were prohibited from leaving the country, and foreigners could not enter without the authorities’ approval. Therefore, the development and adoption of fixed pricing in Japan were largely separated from the rest of the world. After Japan’s reopening in the 19th century, foreign visitors noted the widespread use of fixed pricing in Japan, remarking that while haggling was still common in most other parts of the world, in Japan, “once you set foot in Japan, you pay the same ‘single price’ that Hachirobei Mitsui introduced to an amazed commercial world 250 years ago” (Russell, 1939, p. 74). (Hachirobei Mitsui was the business name of Mitsui Takatoshi.)

1.1.2 Britain

In the pre-industrial era, retail pricing in Europe was primarily determined through negotiation between the consumer and the seller.

James Lackington (1746-1815), a British bookseller, is considered one of the earliest known individuals to have implemented the use of fixed prices in retail in the Western world. Lackington began his career as a bookseller in 1744. In his memoirs, Lackington recalls the implementation of fixed prices in 1780. Lackington’s primary motive for fixed prices was to facilitate business organization and gain a competitive edge. He recognized that giving credit was costly as customers often did not pay their debt or only paid after a long time, which forced the seller to take costly loans. He discontinued extending credit to customers, which was considered a bold move. To compensate for this change and maintain his competitiveness, Lackington established a low but fixed, non-negotiable price for each book and adhered to these prices (Lackington, 1792).

Despite coming from a poor background and receiving little formal education, Lackington taught himself to read by searching for secondhand books in flea markets and living frugally. After starting his own business as a shoemaker, he began selling books on the side before eventually transforming it into a bookstore (Timperley, 1839).

In the 18th century, more and more people were learning to read, but books were still expensive luxuries, and other bookstores could be intimidating places. Lackington drove down prices and made books affordable and accessible to poorer people. However, the guiding idea of his business and pricing decisions was pecuniary. He aimed to accumulate wealth through many sales with a small profit margin.

Fixed prices did not stop Lackington from giving high discounts. During that time, it was common business practice for other booksellers to buy out the lion’s share of a book and destroy most of it to make the remaining copies more valuable. In contrast, Lackington sold all copies at highly discounted prices (Lackington, 1792; Timperley, 1839).

The implementation of fixed prices encountered significant challenges. Due to the lower prices compared to competing businesses, the store’s reputation was negatively affected, and customers were led to believe that the quality of the books would also be lower. In response to this, Lackington introduced a money-back guarantee policy. Despite the initial difficulties, fixed prices ultimately proved beneficial, resulting in the steady growth of Lackington’s business (Mee, 1938/1951).

As a bookseller, Lackington became wealthy and influential, even minting his own coins that could be redeemed in his store, “The Temple of the Muses” at Charing Cross in London. He voluntarily published his costs and profits to be perceived as honest and fair. Although born a Methodist, he rejected Methodist beliefs during his time as a merchant and even made fun of them. He rediscovered his faith only after retirement and became a part-time Methodist preacher (Mee, 1938/1951; Timperley, 1839).

Beyond the adoption of fixed prices, Lackington’s innovations in the bookselling industry had a meaningful impact on the evolution of the modern bookstore. They contributed to the democratization of literature, making books more affordable and accessible to a broader range of individuals (Lackington, 1792).

By the end of the 18th century, haggling remained prevalent in England, but fixed-price systems were gaining popularity. This trend rapidly expanded beyond major cities, and by 1806, even smaller country stores had adopted fixed prices, price tags, and warranty services (Fowler, 1998). The adoption of fixed prices continued to spread (Adburgham, 1981), and by the mid-1850s, a French visitor noted with surprise that haggling was uncommon and viewed as impolite in England (Davis, 2013).

It should be noted that Lackington is often credited as the pioneer of fixed prices in Britain. However, he did not invent it. There are earlier records of fixed pricing, specifically among the Quakers,[2] who believed that charging different prices to different individuals was immoral. As such, in the 1650s, one of their founders and leaders, George Fox, requested that his merchant followers establish a single price (Fox, 1694/2010).

The Quakers’ adoption of fixed prices was primarily motivated by their religious beliefs. According to Weber (1904/2016, 1946), the Quakers were driven by individual salvation, which they believed could be achieved through hard work and honesty in all aspects of life. They believed that God was present in all people and that everyone, regardless of social class, should be treated equally (Fox, 1674). However, the resulting wealth was a double-edged sword. Too much wealth was seen as a distraction from their faith, while too little was seen as a sign of idleness and a lack of effort in worshipping God.

While Weber (1904/2016) argues that individual salvation was the central motive for adopting the fair price and that social and economic consequences were only of secondary importance, Kent (1983) suggests that additional motives were at play. The Quakers were frustrated by the seemingly selfish business practices of the time. They believed that one could please God only by being honest and charging everybody the same. In their view, charging everyone the same was a way to decrease social inequality and promote fairness in society (Fox, 1658; Kent, 1983).

However, the pricing mechanism did not gain widespread acceptance outside of the Quaker community, as customers at the time largely rejected this change (Edmundson, 1774; Fox, 1694/2010; Hower, 1943) and got furious when deprived of their right to haggle (Toldervy, 1655). The Quakers also faced opposition from other Protestant faith groups who believed that fixed prices were unfair as they benefitted the rich, who should pay more to achieve fair prices (Kent, 1983; Weber, 1946). Nonetheless, the Quakers continued to use fixed pricing as a pricing mechanism, as another French traveler remarked with surprise in 1792 (de Saussure, 1902).

1.1.3 France

Like other countries, France has a claimed inventor of the fixed pricing system, Aristide Boucicaut (1810-1877) (Gosmann, 2013; Thivierge, 1989). Before the 19th century, haggling was the standard method of conducting transactions. Boucicaut came from humble origins and initially worked as a salesperson. (Gosmann, 2013; Thivierge, 1989). He joined Le Bon Marché as a co-owner in 1853. The small retail store identified a demand for a new type of retailer that offered a wider range of products. He was instrumental in establishing the concept of the department store in France through the expansion of product offerings, enabling customers to purchase a variety of items under one roof. This was when he abolished credit and introduced the use of fixed prices for products (d’Avenel, 1896; Moreuil, 1970).

Boucicaut was Catholic, and his faith profoundly impacted his business practices. His store was renowned for its virtuous reputation, which with fixed pricing, became a defining trait of the Bon Marché brand. Boucicaut’s religious convictions were so strong that some people even speculated he had direct ties to the Church. He held high moral standards for his employees and ensured they received religious instruction, and followed the fixed price paradigm (Miller, 1981).

The emergence of fixed pricing can be attributed to a larger societal shift. To target the growing bourgeoisie, Boucicaut offered products at lower prices, implemented refund and warranty policies, and provided unrestricted access to his store (Beauvais, 2004; Hower, 1943). This contrasted with the competition of high-end boutiques. Boucicaut utilized shop windows and vitrines to display goods and ensured wide aisles and ample space for customers to browse leisurely. Later, he extended his offerings to include home delivery and mail orders through catalogs (Pasdermadjian, 1954). Le Bon Marché made Boucicaut one of the wealthiest individuals in France during his time. When Boucicaut died in 1877, his wife, Marguerite Boucicaut, took over the store’s management and continued to expand and innovate.

The rise of consumerism led to the growth of department stores that adopted fixed pricing, allowing them to compete with traditional retailers who still used negotiated prices (Gosmann, 2013). The result was a price war between Le Bon Marché, other emerging department stores, and traditional retailers. The intense price competition favored department stores that operated on a low-margin, high-volume model. Department stores grew at the expense of specialty shops and neighborhood stores. In Paris, by the early 1900s, even smaller businesses such as butchers, dairy shops, clothing stores, and restaurants adopted fixed pricing (Saint-Léon, 1911; Wemp, 2010). However, in the countryside, fixed pricing and bargaining coexisted until after World War II (Braudel & Labrousse, 1970).

Although Boucicaut is widely credited as the pioneer of fixed pricing, there is evidence of its existence in France before his time. In 1786, other merchants raised concerns about stores that had adopted fixed prices (Saint-Léon, 1911). Other sources indicate that fixed pricing was in use as early as 1800 (Ambrière, 1932) and that the Parisian bazaar and jewelry seller Petit Dunkerque was among the first stores to adopt the practice (Jarry, 1948; Sombart, 1922). Additionally, dry goods and clothing stores (magasins de nouveautés) in Paris used fixed prices in the 1820s (Jarry, 1948), 1830s (Jarry, 1948; Miller, 1981), and 1840s (Brandt et al., 2014; Hower, 1943).

1.1.4 U.S.

The United States also claim to the origin of fixed prices, with three names frequently mentioned: Alexander Turney Stewart, Rowland Hussey Macy, and John Wanamaker (Grinder & Cooper, 2022; Tamilia, 2011; Tamilia & Reid, 2007).

Stewart (1803-1876), an Irish immigrant, is credited with pioneering the department store model and being the first to use uniform fixed pricing in the U.S. Although he never advertised it, he had adopted fixed pricing by at least 1846 (Appel, 1930; Miller, 1981; Resseguie, 1962, 1965; Tamilia & Reid, 2007). Stewart began with a small store that eventually grew into a department store and later into a business empire, making him one of the wealthiest Americans. At the time, selfish business practices, customer deception, and haggling were the norm. In Stewart’s store, customers had to pay in cash, as little to no credit was given. Prices and profit margins were kept low, and customer satisfaction was prioritized. Steward came from a religious family, and after his father died at a young age and his mother left him behind, his grandfather and later a Quaker friend raised him (Brockett, 1868). Consequently, Stewart valued honesty and discouraged salespeople from exaggerating the quality of their goods. He believed in setting affordable prices to limit competition, increase sales, and ensure long-term success by accumulating capital (Surdam, 2020).

Macy (1822-1877), a Quaker who began his career as a sailor, opened a dry-goods store in Massachusetts in 1851 that sold exclusively for cash and with fixed prices (Hower, 1943). After struggling in a rural environment, he relocated to New York City and opened R. H. Macy & Co. as a department store, again adhering to fixed prices. The store’s success helped establish the department store format as a major retail presence in the U.S., and it continues to operate today under the name Macy’s. He combined fixed pricing with other novel retail strategies, such as low-price positioning, a low-price guarantee, and odd pricing (e.g., prices ending in .89, .93). He also heavily advertised this positioning, emphasizing the fixed price aspect. This marked a significant departure from prior retail practices, making fixed pricing a cornerstone of Macy’s successful department store business model (Hower, 1943).

Wanamaker (1838-1922) came up with a similar idea. In 1861, Wanamaker opened his first store, “Oak Hall” in Philadelphia, and later established a larger store, “Wanamaker’s,” in 1876. As a competitor of Macy’s and other emerging department stores, he adopted fixed pricing and introduced a novel concept of labeling all goods with their respective prices, referred to as “price tags.” It is said that before Wanamaker, U.S. retailers would not display product prices, requiring customers to seek out a salesperson for each item’s price, which could be time-consuming and deter some customers from purchasing. The introduction of price tags revolutionized retail and was quickly adopted by the industry. Wanamaker was a devout Presbyterian. He valued hard work, honesty, and equality (Appel, 1930; Grinder & Cooper, 2022). He was also a philanthropist who donated generously to various causes. The fixed (and low) prices were advertised as a particularly fair policy. Wanamaker’s contributions to the retail industry extended beyond fixed pricing. He was influenced by Le Bon Marché in Paris and expanded the product range at his store, offering money-back guarantees and employing innovative advertising methods. This helped further to popularize the department store format in the United States.

The introduction of fixed prices and price tags enabled customers to compare prices across stores, leading to intense competition and price wars among department stores. This competition also spurred the adoption of innovations outside business strategies, such as elevators and electrical lighting (Hower, 1943; Pasdermadjian, 1954).

The origin of fixed pricing in the U.S. is disputed; some merchants have already experimented with this practice. In 1817, Arthur Tappan, a carpet and dry goods seller best known as an abolitionist, implemented fixed pricing in his business, motivated by his Christian beliefs. However, this did not gain widespread adoption, and competitors continued to use haggling (Tappan, 1870). Further use of fixed prices in New York in the 1840s (Appel, 1930) and small country stores in the 1830s (Norris, 1962) have been documented. However, there was some suspicion that fixed price policies were a disguise for higher prices and a sophisticated and unfair haggling strategy (Resseguie, 1965). Wanamaker acknowledged Stewart for originating the policy and credited himself with establishing it (Appel, 1930), but it is more likely that fixed prices resulted from continuous development. The practice of haggling gradually declined in the 19th century (Barth, 1982) but continued to be used well into the 20th century (Appel, 1930).

There is a disagreement about the origin of the fixed-price innovation in the U.S. Some sources suggest that fixed pricing was first implemented in Britain and France and was later adopted by American merchants (Nystrom, 1915; Pasdermadjian, 1954). Meanwhile, other sources indicate that the development of fixed pricing was concurrent in both the U.S. and Europe (Appel, 1930; Hower, 1943; Norris, 1962; Tamilia, 2011). Evidence supports both arguments, as early U.S. and European cases of fixed prices were parallel, but the final success of the policy was achieved by adopting department stores with extensive product offerings and fixed prices.

1.1.5 China

The use of fixed prices in China during the 19th century is largely unknown. However, the idea of government price controls was well-established (Weber, 2021). During the Ming and Qing dynasties, state orders and imperial edicts determined prices, including grain and rice prices. However, merchants’ and traders’ adherence to these prices remains unclear (Allen et al., 2011).

Ma Yingbiao (馬應彪, 1860-1944), born in Guangdong Province, moved to Australia at the age of 19 to work at a gold mine and later as a salesclerk. Influenced by Western values, he was impressed by Sydney’s flagship department store, Anthony Hordern & Sons, which used fixed prices. During his time in Australia, Ma converted to Presbyterian Christianity (Austin, 2011). Upon returning to Hong Kong, he opened the first Chinese-owned department store, the Sincere Company (先施百貨), in 1900 and strongly advocated for clearly marked prices so that customers could choose goods based on price. The name “Sincere” alludes to fixed prices being seen as honest and fair (Chan, 2010). Sincere mandated its employees to attend Christian services on Sunday mornings but also integrated the Confucian principle of developing character with the Christian values of overseas Chinese (Chan, 1996; Hong, 2016). The success of the Sincere Company led to its expansion to Shanghai and Guangzhou in the 1910s. The company continues to exist to the present day. Shortly after the establishment of Sincere, other department stores, such as Wing On (永安百貨), Sun Sun (新新公司), and Dah Sun (大新公司), entered the market. They were also influenced by Protestantism and adopted the fixed pricing mechanism, leading to tough competition.

The introduction of fixed prices by Ma Yingbiao at the Sincere Company was accompanied by several other innovations, including the employment of women as salesclerks and the display of goods in an elaborate manner, despite the high financial costs. However, due to backlash, hiring female clerks had to be discontinued for over thirty years (Chan, 1996). The fixed price was a significant advertising proposition for department stores and continues to be viewed as a signal of honesty (Peng, 2011).

The use of fixed pricing before Ma Yingbiao’s implementation in 1900 is debated. While haggling was widespread in small-scale markets in China, some department stores in the International Settlement in Shanghai, operated by English merchants, may have used fixed pricing. However, their clientele was primarily foreign residents, thus having limited impact on the Chinese retail sector (Chan, 1996; Clifford, 1991; Rawski, 1989).

The concept of fixed pricing is present in Chinese history, as evidenced by the idiom 真不二價 or 不二價 (pinyin: zhēn bù èrjià or bù èrjià), which translates to “no second price” or “no bargaining.” This idiom is believed to have originated from ancient businessman Han Kang who sold medicinal products and refused to sell for any price other than what was initially announced, as it represented his goods’ true value and quality. However, this pricing method was only used sparingly in Chinese medicine shops and was not widely adopted in the retail sector until the modern era.

Fixed prices set by companies in China were a fleeting concept. After the Communist Revolution in 1949, companies were dissolved, and price setting became the sole responsibility of the government. For 30 years, the government centrally set prices for most goods and services, such as food, housing, and fuel, at artificially low levels (Chao & Hsiang, 1969). However, such control resulted in economic imbalances, giving rise to a thriving black market and the return of haggling based on the principles of supply and demand. In 1979, the Chinese government introduced the pricing reform to return to market pricing and company-set fixed prices. This allowed state companies and the market to independently set prices for certain parts of production (Li, 1989).

1.2 Dynamic prices

The use of non-negotiable pricing for products and services was widespread after World War II in both Western and Communist nations. In theory, companies set prices in the Western world, while the government sets a single price in Communist countries. However, both systems were often combined in practice. State-owned firms dominated heavily regulated industries in the Western world, while some entrepreneurship was permitted in Communist countries.

Managers’ and academics’ efforts centered mainly on determining the optimal fixed price until the late 1970s. This shifted when companies started adopting variable pricing strategies, charging different prices for the same item based on the time of sale. This evolution will be referred to as dynamic pricing and will be the focus of this chapter. Dynamic pricing refers to adjusting prices of goods or services in real-time based on market demand, supply, and other relevant factors, determined solely by the seller. Like with fixed prices, the price is communicated to the buyer, who can accept or reject the offer (take-it-or-leave-it offer). Yet, buyers typically pay different prices depending on when they buy. This pricing method often employs complex mathematical algorithms and data analytics to inform its decisions. A discussion of the different definitions of dynamic pricing can be found in Gönsch et al. (2009).

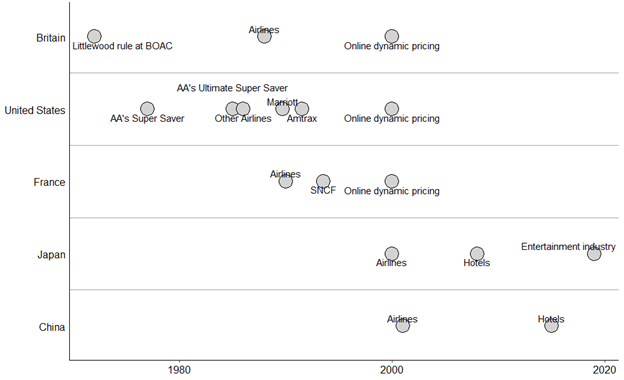

Figure 2: A timeline of selected cases of the dynamic pricing adoption

The evolution of dynamic pricing started in the airline industry in Western countries, originating from revenue management. Commencing in the late 1950s, studies on forecasting models aimed to address operational challenges such as managing cancellations, overbooking, and no-shows, as well as determining the appropriate number of tickets to sell to prevent empty or overbooked seats (Beckmann & Bobkoski, 1958). The concept was called yield management and, later, revenue management. The goal was to analyze the optimal allocation of capacity to different airline classes and the establishment of prices for each class.[3] Ultimately, revenue management aims to maximize profits (McGill & van Ryzin, 1999). Figure 2 gives an overview of the adoption of dynamic prices in different countries and industries.

1.2.1 The first use of revenue management in Britain

These models led to revenue management-driven dynamic pricing in the early 1970s in Great Britain. The BOAC (British Overseas Airways Corporation, now British Airways) developed a mathematical model to predict customer demand, enabling dynamic pricing implementation for revenue optimization (Littlewood, 1972/2005; Yeoman & McMahon-Beattie, 2017). Although applied to all economy class flights, customers who booked at least 21 days before departure received a discount compared to those who booked closer to the departure date. The algorithms aimed to find the optimal balance between discounted seats that could be sold and non-discounted seats that needed to be reserved for last-minute bookings, an optimization task known as yield management at the time and revenue management today (Cross et al., 2009; McGill & van Ryzin, 1999). Thus, the revenue was optimized instead of optimizing seat sales (Vinod, 2009). This is commonly referred to as the Littlewood Rule (Littlewood, 1972/2005).

1.2.2 Development of revenue management in the U.S. airline industry

Before 1978, the airline industry in the United States was heavily regulated, with prices and routes controlled by the Civil Aeronautics Board. Airlines were guaranteed a 12% return on half-full flights by the government’s set prices (Vinod, 2016; Yeoman & McMahon-Beattie, 2017). Thus, pricing was not a focus for airlines for a few years. Instead, the evolving industry faced operational challenges, including implementing a functional booking system and reducing costs.

Robert L. Crandall (born 1935) is recognized as a pioneer of dynamic pricing innovation. Crandall earned a reputation as a ‘tough guy’ while at American Airlines. Coming from a humble background, he aimed to adhere to high ethical standards, including maintaining integrity, fulfilling commitments, following a moral path, and striving for excellence (Crandall, 2022). Crandall’s primary motive was determined to win against competitors. He prioritized achieving the best possible results for his company and shareholders, even if it meant making tough decisions (e.g., hiring and firing friends) (Cross, 1997; Graham et al., 1992).

In the mid-1970s, as Senior Vice President of Marketing for American Airlines, he and his colleagues were brainstorming ways to cut costs when they realized that planes were only flying at half capacity. This led them to realize that the airline industry had a revenue problem rather than a cost problem (Cross, 1997). In addition to efficiency-related reasons, Crandall also recognized pecuniary motives for introducing revenue management: “If we could figure out a way to sell those empty seats […], we would make a lot of dough” (Cross, 1997, p. 111). American Airlines’ Super Saver discount fares for advanced booking in 1977 resulted from this brainstorming session (Smith et al., 1992; Vinod, 2016). They were highly successful and copied by other airlines (Cross, 1997).

However, it was just the beginning of dynamic pricing. The Airline Deregulation Act of 1978 eliminated restrictions on domestic routes and fare regulations, leading to the entry of low-cost carriers and intense competition. Low-cost carriers, most notably PeopleExpress, offered reduced services at a low fixed price. PeopleExpress implemented an unbundling strategy that separated all non-flight services, including baggage handling, booking service, and meals, from the basic ticket price and charged supplementary fees for these services. Customers had to book their reservations directly instead of utilizing agents, and tickets could be purchased onboard the aircraft. This approach resulted in a significantly lower cost structure for these airlines, reducing expenses by 50% compared to major carriers. This allowed low-cost carriers to target less affluent customers and make flying available for everybody but also put pressure on established airlines whose revenues and passenger numbers declined and were struggling to survive (Cross, 1997; Cross et al., 2011; Koten, 1984).

Crandall, who was subsequently promoted to CEO of American Airlines, devised a countermeasure. To retain high prices from business travelers and attract price-sensitive customers, American Airlines was the first to introduce an updated version of revenue management with more aggressive dynamic pricing with its Ultimate Super Saver fare in 1985. In contrast to the previous iteration, American Airlines was leveraging cutting-edge computational capabilities; the revised dynamic pricing mechanism enabled the airline to target discounted fares more precisely. The Ultimate Super Saver offered competitive, constantly changing prices for customers who booked up to 30 days before travel and stayed over the weekend.

At first, competitors reacted with skepticism and strong opposition to the low-cost strategy, viewing it as a potential threat to their future profitability. They believed that dynamic pricing strategies would not be well-received by customers. The norm was that everybody should pay the same, and it was thought that customers would not tolerate different prices for the same product and that the government would view such practices as bait pricing and intervene accordingly. Notably, the decision to implement dynamic pricing strategies rested with American Airlines’ marketing department and the CEO but lacked significant consideration of the consumers’ fairness perceptions and ethical issues. In fact, customers were viewed simply as rational economic agents rather than consumers with complex personalities. However, consumers generally reacted positively to dynamic pricing contrary to initial expectations. Many felt they could benefit from lower prices and receive the same level of service as they would from a traditional airline (Cross, 1997). One year later, other airlines quickly adopted this model, making it an integral part of revenue management (Cross, 1997; Huefner, 2011; Vinod, 2009).

In addition to his pioneering work on dynamic pricing, Crandall is recognized for his contributions to the airline industry. One of his most notable achievements was creating the first frequent-flier program at American Airlines, which revolutionized how airlines interacted with their customers (Graham et al., 1992).

1.2.3 Evolution of dynamic pricing in other industries in the West

The development of revenue management and dynamic pricing in Western countries during the 1980s and 1990s was marked by distinct differences from the development of fixed pricing. Unlike the determination of fixed prices, made by the owner, employees advanced revenue management. These specialists regularly interacted with peers and academia through professional conferences and communication networks. Overcoming language barriers facilitated the exchange of expertise and the hiring of specialists from rival organizations. As a result, the adoption of dynamic pricing within the airline industry in the Western world was rapid and widespread, with most airlines adopting some form of dynamic pricing within a decade.

Dynamic pricing evolved in industries with capacity limitations similar to airlines. Marriott was the first company in the hotel industry to implement revenue management and dynamic pricing in the late 1980s (Kimes, 2016). Other hotels followed in the 1990s (Hanks, 2002). However, compared to the airline industry, the more fragmented industry structure limited the widespread application (Kimes, 2016). The national passenger rail systems of the United States, Amtrak, and France, SNCF, adopted revenue management and dynamic pricing in 1991 and 1993, respectively (Ben-Khedher et al., 1998; Vinod, 2016). Currently, most European railway companies use revenue management (Hohberger, 2020).

Before the late 1990s, dynamic pricing beyond these industries was considered too complex and infeasible. Kimes (1989) identified six critical factors necessary for implementing dynamic pricing: fixed or limited capacities, high fixed costs, low marginal costs, capacity perishability, significant fluctuations in demand, the possibility for advance booking, and the possibility of market segmentation and price differentiation.

However, with the advent of the internet and e-commerce in the late 1990s and early 2000s, dynamic pricing also gained popularity in retail and beyond capacity-driven industries in travel and hospitality. The increased availability of data, advanced technology for quick pricing adjustments, and improved analytical capabilities presented a significant challenge to traditional pricing strategies and an opportunity to implement dynamic pricing (Elmaghraby & Keskinocak, 2003). Online retailers, such as Amazon and eBay, widely adopt dynamic pricing algorithms in North America and Europe to adjust prices multiple times a day based on demand, inventory, and competition. Ride-sharing companies like Uber and Lyft also employ dynamic pricing by considering factors such as time of day, location, and ride demand to adjust fares. In the ticketing industry, companies such as Ticketmaster and StubHub adjust ticket prices based on event popularity and the availability of tickets. There are a few instances of brick-and-mortar stores that use electronic shelf-labels to implement dynamic pricing as well.

Ethical dimensions of dynamic pricing were little considered. During the Reagan era in corporate America, fairness considerations were perceived as weak and insignificant (Mueller, 2004). The dominating logic of Chicago economics, emphasizing free markets and rationality, added to this trend. From a customer perspective, dynamic prices were acceptable with a significant discount and reasonable restrictions (Kimes 1994). More recently, the ethics of dynamic pricing have been debated more (Elegido, 2011; Gerlick & Liozu, 2020; Haws & Bearden, 2006; Nunan & Di Domenico, 2022; Seele et al., 2021; Selove, 2019).

In Japan and China, the implementation of dynamic pricing deviated from the pattern observed in North America and Europe.

1.2.4 Dynamic pricing in Japan

In Japan, the adoption of dynamic pricing has been slow despite the exchange of ideas with Western countries and Japanese researchers studying in the West. Japanese companies did not implement dynamic pricing mechanisms in the 1980s and 1990s. This was primarily due to government regulations limiting Japanese airlines’ ability to implement revenue management practices. However, after market deregulation in 2000, companies gradually began adopting revenue management and dynamic pricing in the 2000s (Eguchi & Belobaba, 2004). Influenced by their international counterparts, Japanese hotels have since adopted dynamic pricing. In the Japanese railway industry, dynamic pricing has yet to be implemented due to regulation and government approval required for rail prices. Despite discussions on the topic for a long time (Abe, 2007; Bugalia et al., 2021; Yasutomi, 2016), the government only began considering its implementation in 2021. Similarly, dynamic pricing mechanisms were only recently adopted in industries such as theme parks, parking lots, and sporting venues.[4]

1.2.5 Dynamic pricing in China

Dynamic prices were also slow to be adopted in China. Several factors contributed to this, including the new prosperity brought about by opening the Chinese market and the subsequent economic growth, which made dynamic pricing unnecessary. Additionally, there was a lack of knowledge regarding dynamic pricing techniques, which were primarily developed in the West. Furthermore, government regulations and price controls posed obstacles to implementing dynamic pricing (Yang, 2009; Yuan & Nie, 2020; Zheng & Liu, 2016). After the market was deregulated in 2000, airlines were the first industry in China to adopt revenue management systems and dynamic pricing. China Southern was the first to adopt revenue management in 2001, followed by China Eastern and Air China in 2003. Implementing dynamic pricing was not straightforward due to various challenges, including airlines’ lack of pricing power as resellers primarily sold tickets, government price controls, and knowledge limitations (Yang et al., 2009). The adoption of dynamic pricing and revenue management in the hotel industry in China was similarly delayed. Although some international hotel chains have implemented these practices, widespread adoption did not occur until recently (Li & Ma. 2017; Yang et al., 2009). In contrast, the railway industry still operates under government price regulations and has yet to implement dynamic pricing or revenue management.

2 Learning from pricing innovation

In this section, we will analyze and compare two pricing innovations regarding their historical background, the sellers’ biographic, religious, and moral background, and the roles of the sellers and consumers in the diffusion process.

2.1 Historical innovation patterns: Two waves

The following section will examine the recurring themes observed in implementing the two pricing innovations, fixed and dynamic pricing. The development and adoption of both pricing innovations were gradual. These pricing mechanisms represent significant modifications in how prices are established and market transactions are carried out. However, no sudden realization or “eureka” moment marked the introduction of either fixed or dynamic prices. The shift toward their implementation occurred gradually over time (Davis, 2013).

The evolution of fixed pricing occurred in two waves. During the first wave, between 1600 and 1850, early advocates of fixed pricing were driven by religious or moral motivations, viewing uniform pricing for all customers as fair and honest. Despite this, adopting fixed pricing was limited as competitors ignored it, and customers were resistant. Fixed pricing was only seen as a peripheral practice. The first introducers of fixed pricing went unnamed. China had some prior experience with fixed prices but was the only country studied that did not see the first wave of gradual introduction before the emergence of the department store. The second wave saw fixed pricing establish itself as the primary pricing strategy, driven by practical considerations such as the growth of industrialization and the rise of the European consumerist movement. The Meiji Restoration ended Japan’s isolation and brought department stores to Japan, transforming the retail sector again. Fixed pricing, however, was already established before this (Hong, 2016).

The adoption of fixed pricing as the dominant pricing strategy across countries shows two main threads of development - an independent evolution in Japan and a Western-Chinese evolution. The department store model facilitated the successful implementation of fixed prices, which offered a wide range of products and a price-sensitive clientele, necessitating low prices. Other innovations from the department store, such as advertising, warranties, low-price guarantees, and home delivery, also contributed to the success of fixed prices.

Paralleling the development of fixed pricing, the implementation of dynamic pricing evolved gradually in two phases. The first wave of dynamic pricing adoption started in the late 1970s and occurred primarily in the airline industry under the guise of revenue management and filling capacity. Dynamic pricing allowed revenue advantages through implicit temporal price differentiation and revenue advantages through response to random demand fluctuations (Gönsch et al., 2009). This method was gradually adopted in other industries with capacity constraints, such as hotels and train industries, driven by technological advancements and primarily utilized by larger enterprises.

The second wave in the adoption of dynamic prices paralleled the rise of e-commerce. As e-commerce developed and advanced, the accompanying software technology also advanced. This resulted in a renewed emphasis on pricing in e-commerce, albeit in a different manner. The growth of e-commerce has led to increased price competitiveness, with market prices for products frequently changing multiple times a day in response to consumer demand.

In conclusion, fixed and dynamic pricing have continuously evolved and gained widespread acceptance as a leading pricing strategy once the appropriate platform was available (e.g., department stores for fixed pricing and airline industry/e-commerce for dynamic pricing). This is a trend that we can observe similarly in other fields of innovation. Pricing innovation should not be confused with the invention of a new pricing method. The origins of pricing inventions, such as the first person who implemented fixed pricing in ancient civilizations like Greece, Rome, Egypt, and China, are unknown. Similarly, ideas of dynamic pricing have existed for a long time but were previously deemed unfeasible (den Boer, 2015).

Going (1911) once cleverly formulated the idea that our world very often had as much creative genius and inventiveness as it could handle, meaning that it only made use of an invention at the right moment. For example, the economist cited the steam engine, which was often invented, set aside, and rediscovered. Only at the end of the 18th century was it able to establish itself because this time’s economic and social conditions were particularly favorable for its application (Pasdermadjian, 1954). According to Schumpeter (1934/2021), the social environment often responds unfavorably to new ideas, attempting to suppress even minor innovations by imposing bans or subjecting innovators to social condemnation. This backlash is evident in all five countries regarding fixed-price innovation. More recently, Ridley (2020) claims that innovation is usually gradual and not sudden. Sudden leaps are rare and often the result of long stretches of preparation, multiple wrong turns, and hindsight. Successful innovation follows a consistent path and can be seen in small incremental steps rather than sudden breakthroughs. He concludes that it is often not the first inventor who has a lasting impact on society, but rather the innovator who effectively implements the innovation in the appropriate context and at the appropriate time.

2.2 Biographic, religious, and moral drivers of pricing innovations

The innovators discussed above share striking similarities. Most came from poor (Lackington, Boucicaut, Macy, Wannamaker, Ma, Crandall) or modest (Mitsui, Fox, Tappan, Stewart) backgrounds, and most rose to incredible wealth, power, and fame. Mitsui, Lackington, Boucicaut, Stewart, and Wanamaker were among the wealthiest people in their societies before they passed away.

All the innovators had strong values that followed them throughout their lives. All believed in hard work, and most shied away from a luxurious lifestyle despite their wealth. Their puritan religious values often guided this. Except for Lackington and Crandall, religious beliefs were the guiding principle for introducing price innovations.

Remarkably, most innovators followed Protestantism, reflecting sociological hypotheses from the first part of the 20th century by Weber (1904/1920/2016) or Sombart (1911). This is manifested in their decision to introduce the fixed price. Followers of Fox, Macy, and Stewart followed the Quaker ideology that everybody should be treated the same. Arguments by the other Protestant innovators were similarly driven by honesty and fairness (Wannamaker, Tappan, Ma). The core values Weber attributed to Protestantism - hard work, asceticism, profit orientation, and private entrepreneurship - can also be found in Japanese Buddhism (Basu & Miroshnik, 2021a), and Mitsui’s ethic stresses honesty and high moral standards. The Catholic Boucicaut stands out. While he was very devout, little is known about how this influenced his motives for introducing the fixed price.

Lackington and Crandall, who were not religious during their time as innovators (Crandall, 2022; Mee, 1951; Timperley, 1839), were driven by a different set of values: increasing the efficiency of their operations, becoming more profitable, or simply winning against the competition.

2.3 The consumers’ and sellers’ perspectives on pricing innovations

2.3.1 Supporting factors

Fixed pricing has several advantages for the seller that were cited as major drivers for its success. First, there was increased efficiency. Rather than negotiate a price with each customer, the seller only needs to set the price once. Bargaining requires a significant amount of skill, as the seller must assess the buyer’s willingness to pay, determine a suitable starting price, and clearly understand product costs and overhead expenses to sustain their business in the long run. This process can be more manageable in owner-run shops, but training new salesclerks to be skilled negotiators is a resource and time-consuming task. For larger businesses, the benefits of fixed pricing are even more pronounced. With the hiring of salesclerks, ownership and pricing decision-making were separated. Therefore, the owner’s ability to control the price is diminished. Fixed pricing was introduced as a way for the owner to regain control over the pricing decision by centralizing the pricing decision-making process (Phillips, 2012).

Second, the implementation of fixed pricing was successful in department stores, utilizing complementary marketing strategies such as money-back guarantees, lowest-price guarantees, low-price strategies, and extensive advertising campaigns. The implementation of these strategies was made possible by the adoption of fixed pricing.

Third, there was a psychological argument. Fixed pricing proponents claimed it was a fairer approach, treating all customers equally (Fox, 1694/2010; Lackington, 1792; Scull & Fuller, 1967; Wanamaker, 1911). Additionally, it improved the relationship between buyers and sellers by removing the tension and animosity that arose during the haggling process (Geertz, 1978; Wanamaker, 1911). Fixed pricing also served to justify the unequal power dynamics between buyers and sellers. Department store owners, who became wealthy through successful businesses, could claim that they did so through fair and honest practices (Crow, 1943). Evidence suggests that fixed-price sellers pressured others to adopt the same pricing method through negative publicity and exclusion if they resumed bargaining (Phillips, 2012).

Fourth, a theoretical economic argument proposes the optimality of fixed pricing over haggling (Riley & Zeckhauser, 1983).

From a consumer’s viewpoint, implementing fixed pricing had numerous benefits. Customers who struggled with bargaining no longer had to participate in the negotiation process. Particularly for individuals who were traditionally charged more, such as the upper class, fixed pricing resulted in lower prices. Second, price comparisons across various stores were more straightforward as prices were clearly displayed. Therefore, competition between buyers and sellers shifted towards competition between sellers (Geertz, 1978), resulting in increased perceptions of interpersonal fairness and lower prices (Gelber, 2005). The introduction of price tags also enhanced trust between the store and its customers, as they felt they were being treated fairly and receiving good value. This fostered customer loyalty, a crucial factor for the stores’ long-term success. The adoption of fixed pricing was also aligned with the progressive values of the time, as department stores were perceived as modern and forward-thinking, making various local and foreign goods accessible to a larger portion of society, including the lower classes. On the other hand, haggling was seen as an outdated process for smaller stores (Phillips, 2012).

The widespread acceptance of dynamic pricing can also be explained by the benefit it brings to sellers and consumers. First, from a seller’s standpoint, it effectively addresses the need for capacity utilization, inventory management, and customer outreach through early revenue management techniques. Second, dynamic pricing increases sales and resource efficiency by determining the optimal price at each price point. Third, it enables price differentiation among buyers, which reverses prior limitations imposed by the mostly time-stable fixed pricing. By setting a lower price, usually associated with less convenient purchase and consumption times, and a higher price with more convenient scheduling, the seller allows buyers to self-select according to their willingness to pay. For instance, in the case of a flight, more affluent business travelers may choose to book during the higher-priced period shortly before take-off, while students on a tight budget may accept the inconvenience of booking in advance to pay a lower price. Ultimately, this leads to a rise in seller profitability (Zhao & Zheng, 2000).

From a consumer perspective, discounted fares were welcomed during the initial adoption of dynamic pricing in the airline industry. They were primarily seen as a cost-saving option for consumers. For price-sensitive consumers who can plan ahead, dynamic pricing results in a potential increase in consumer surplus. The price discrimination involved in dynamic pricing does not necessarily have to be unfair or unethical (Elegido, 2011). Like in the case of haggling, price discrimination can redistribute income from less price-sensitive and often wealthier groups to more price-sensitive and often less wealthy groups (Tirole, 1988).

The influence of the buyer on the pricing decision is increased again in dynamic pricing. While haggling allows for a high level of face-to-face influence, fixed pricing minimizes buyer influence. On the other hand, dynamic pricing offers a new level of virtualized influence. When consumers believe they benefit from it, they often support price discrimination in the market (Kimes, 1994). Additionally, from a psychological perspective, dynamic pricing allows consumers to experience the thrill of finding a good deal (bargain hunting) (Choe & Wu, 2015) and to feel good about paying less than others (Lee et al., 2011).

2.3.2 Inhibiting factors

The societal discourse around the new pricing mechanisms was not uncritical, and some arguments were raised against the innovations. The introduction of fixed pricing faced opposition from some sellers, as it impacted their previous business practices. While it provided a standardized pricing method, it also limited the ability of smaller sellers to engage in price discrimination, as they could no longer set different prices for different customers. Previously, bargaining allowed them to set higher prices for wealthy customers and lower prices for those with limited means. The introduction of fixed pricing increased competition, lowered profits for smaller sellers, and led to price wars (Saint-Léon, 1911).

In Europe, before introducing fixed prices, guilds set prices, which limited competition by agreeing on minimum prices (Ogilvie, 2014). Additionally, during the initial implementation of fixed pricing, high-quality sellers negatively perceived it as a threat to their business and a method for selling lower-quality products (Saint-Léon, 1911). The introduction of fixed prices in France during the 18th century was initially met with criticism as they were perceived as unfavorable to the poor. The police even banned fixed prices and encouraged bargaining for staple goods like bread, allowing low-wage workers to obtain a fair price for their baguettes (Forster & Kaplan, 1998). As previously mentioned, fixed pricing eliminates personal interaction in the pricing process and offers the same prices to all consumers, resulting in a standardized relationship between buyers and sellers. Sombart (1922) considered introducing fixed prices as contributing to objectifying the buyer-seller relationship in capitalism. Many consumers were accustomed to bargaining and found it pleasurable. Thus, removing bargaining stripped them of the sense of achievement and dominance in securing a good deal (Jones et al., 1997). Similarly, during the period when fixed pricing was first introduced, it was perceived as a haggling strategy or a signal of bad quality in Britain and the U.S. This trend can still be observed in countries where bargaining remains a common practice (Dawra et al., 2015; Kassaye, 1990).

The resistance to fixed pricing is also evident in the cross-cultural diffusion of innovations. Except for Japan, fixed pricing was established and developed in regions characterized by frequent trade and commerce, such as colonial empires like Britain, France, and the U.S. During that time, fixed prices were implemented in parallel and faced similar opposition from other sellers. There was a cross-cultural exchange between these countries, and the accounts of foreigners visiting regions that already utilized fixed pricing, show that they were taken aback by the concept. This was a reciprocal experience, whether the French in Britain, the British in the U.S., or the Americans in Japan. Across cultures, introducing fixed pricing sparked surprise and initially faced rejection.

Similarly, in China, fixed prices were introduced in Hong Kong and Shanghai, considered among the most open cities in the early 20th century. Fixed prices came along with the rise of department stores, viewed as representing Western values and early capitalism. However, there were reports of fixed pricing being perceived as a colonial, Western concept and nationalist consumers rejecting it as a way to resist imperialism (Hong, 2016).

During implementation, dynamic pricing faced resistance from sellers who had not yet implemented it. The adoption of dynamic pricing technologies creates pressure for competitors also to adopt it, leading to a more competitive market where prices can be easily adjusted in response to market conditions. This can ultimately result in lower prices and reduced profits over time. In contrast to the simplification brought by fixed pricing, dynamic pricing complicates price setting. The implementation of dynamic pricing requires advanced technology, software, hardware, and human resources to accurately set prices for each product. As demonstrated by the bankruptcy of PeopleExpress after American Airlines introduced dynamic pricing, a lack of related technology can have negative consequences. Dynamic pricing also reduces the power of managers over pricing decisions and requires using algorithms that must be accurate, transparent, and fair to avoid legal and ethical issues. Despite this, managers often retain control over pricing decisions in dynamic pricing rather than delegating it to employees (Wamsler et al., 2022). Regardless of success stories, many companies have failed to implement dynamic pricing correctly and abandoned the approach.

In some cases, companies experimenting with dynamic pricing faced criticism for charging higher prices from media and customers (Yang, 2020). There are also concerns about the consumer’s reactions when facing dynamic prices, with some industries, such as movie theaters opting not to use dynamic pricing despite meeting its criteria. This can be attributed to a conservative approach (Orbach, 2004). Additionally, sellers are often concerned about losing their pricing image and customer loyalty if dynamic pricing is implemented (Seele et al., 2021).

The initial innovators of dynamic pricing in the digital sphere faced significant resistance from the media and consumers. Perceptions of fairness and trust in dynamic pricing were viewed negatively (Garbarino & Lee, 2003; Haws & Bearden, 2006). This can be attributed to the power imbalance created by dynamic pricing, which allows sellers to target weaker customers using vast amounts of consumer behavioral data. Dynamic pricing also decreases price certainty for customers, making it harder for them to plan and increasing their uncertainty. Additionally, the decreased price transparency in dynamic pricing creates ethical issues for the seller and erodes its credibility (Seele et al., 2021). There is also a cross-cultural variation in the adoption of dynamic pricing, with consumers in collectivist cultures being more sensitive to price comparisons within their in-group (Bolton et al., 2010). This partly explains why dynamic pricing is more regulated or rejected in collectivist cultures such as Japan and China.

In conclusion, there are several common themes in fixed and dynamic pricing diffusion patterns. In both cases, the acceptance of the new pricing system was driven by mutual benefits for sellers and buyers. Sellers who adopted the innovation could better utilize their resources and increase sales and profits, while buyers benefited from lower prices and a better product offering. As a result, both pricing innovations, by and large, led to a democratization of consumption, making products that were previously only accessible to the wealthy more affordable to a larger consumer group. There were some exceptions. The poorest of the poor benefited from haggling for their daily necessities, and similarly, airline passengers who needed a last-minute flight on an almost booked plane were better off with fixed prices than dynamic prices. A second feature of the diffusion pattern of both pricing innovations is that their successful and lasting introduction started in larger organizations and was later adopted by smaller ones. It is worth noting that except for fixed pricing in Japan, both innovations were seen as a Western, modern way of doing business and challenged traditional cultural practices in Eastern countries. These similarities suggest that economic and cultural factors influence the diffusion of pricing innovations.

In addition to these similarities, however, there are also contradictory features in the two price mechanisms. On the one hand, fixed pricing streamlined the pricing process and reduced labor costs. On the other hand, dynamic pricing resulted in a more complex pricing structure. However, computer technology enabled automated pricing processes, removing the personal touch from pricing decisions. Additionally, while fixed pricing was perceived as promoting price fairness, dynamic pricing was seen as a decline in price fairness, suggesting that price fairness does not appear to be a determining factor in the diffusion of pricing innovations.

3 Conclusion

The present research examined how two pricing innovations, fixed pricing and dynamic pricing, became the modi operandi in pricing. We could map the acceptance of fixed and dynamic pricing by introducing innovation and implementation patterns in five countries, three from the West and two from the East. While there are colorful stories of some innovators who came up with the idea of fixed pricing, we find evidence that the implementation of fixed and dynamic pricing as leading pricing strategies developed gradually over time. Fixed pricing evolved in two waves, with early adopters driven by religious or moral motivations and the shift towards it occurring gradually over time. The growth of the department store model further facilitated the successful implementation of fixed pricing. Dynamic pricing also evolved in two phases, with the first wave starting in the late 1970s in the airline industry and the second wave paralleling the rise of e-commerce. Innovations in software technology allowed for increased competitiveness in e-commerce and frequent price changes in response to consumer demand.

Furthermore, we discussed why the innovating firm was motivated to innovate and how competitors and customers reacted to the innovation. According to economic theory, fixed pricing has advantages for the seller, such as increased efficiency and control, improved buyer-seller relationship, and optimization. From a consumer’s viewpoint, fixed pricing makes negotiation easier, allows for easier price comparisons, increases trust in the seller, and aligns with progressive values. Dynamic pricing benefits the seller by addressing capacity utilization, improving resource efficiency, and enabling price differentiation. Consumers benefit from discounts and the excitement of finding a good deal. However, introducing fixed pricing faced opposition from some sellers, led to price wars, and negatively impacted smaller sellers’ profits. Dynamic pricing raises concerns about fairness and has been criticized for price discrimination.

On a personal level, the innovators were a diverse group of individuals who shared a commitment to hard work, honesty, and fairness. Their religious beliefs, mostly Protestant, played a significant role in their decision to introduce fixed pricing, reflecting the values of their respective cultures and religions. However, there are also examples of fixed prices and dynamic prices being introduced for pecuniary reasons.

The outcomes of this study have implications for future pricing innovations. The evolution of pricing is an ongoing process, and the examination of fixed and dynamic pricing in this research constitutes just a fraction of the many pricing innovations that exist. Nevertheless, the key factors that contributed to the adoption of fixed and dynamic pricing: mutual benefits for buyers and sellers, competitive pressure for smaller sellers to adopt the innovative pricing mechanism, and market expansion by including less affluent customer groups, are interesting guidelines for the success of future pricing innovations.

The diffusion of dynamic pricing may be the precursor to further advancements in algorithmic pricing. In this context, using big data, including personal and competitive data, may lead to the developing of new pricing systems, such as personalized and collusive pricing mechanisms (Ezrachi & Stucke, 2016; Seele et al., 2021). The current societal reaction to the proliferation of algorithmic pricing mechanisms, including personalized pricing, is a topic of ongoing discourse. The integration of AI into pricing has the potential to bring about both technical and societal challenges. As the availability of big data increases, algorithmic pricing and personalized pricing will likely expand, raising concerns about privacy and fairness in pricing. While regulatory bodies such as the European Union are monitoring the developments, there are currently no established regulations (European Union & Directorate for Financial and Enterprise Affairs, 2018; Rott et al., 2022). The debate surrounding the benefits and drawbacks of these pricing systems revolves around similar topics as in the case of fixed and dynamic pricing. What are the advantages for larger vs. smaller sellers, and what is the potential benefit and harm for consumers? This discourse highlights the need for greater scrutiny to ensure that algorithmic pricing does not exploit the vulnerable (Chen et al., 2022; Gerlick & Liozu, 2020; Richards et al., 2016).

The present research was limited in scope to examining fixed and dynamic pricing innovations and did not explore other pricing mechanisms and pricing innovations that failed to gain widespread adoption. The advent of the internet has facilitated the emergence and popularity of various pricing strategies such as auctions, pay-what-you-want, or name-your-own-price, among others, with varying levels of success. The underutilization of the name-your-own-price pricing strategy, once popularized by Priceline.com, may provide valuable insight into why some pricing innovations are not widely adopted. Additionally, the study was limited to five countries. While those countries are (at least partially) success stories of fixed and dynamic pricing, others have largely rejected both innovations (Bin Ahmad Alserhan, 2009; Kassaye, 1990; Kramer & Herbig, 1993). A more comprehensive examination of fixed and dynamic pricing in other regions, such as the former Soviet countries, South America, Africa, or the Middle East, could provide valuable insights into their innovation and diffusion patterns.

References

Abe, I. (2007). Revenue Management in the Railway Industry in Japan and Portugal: A Stakeholder Approach. Massachusetts Institute of Technology.

Adburgham, A. (1981). Shops and Shopping, 1800-1914 (2nd ed.). HarperCollins.

Allen, R. C., Bassino, J., Ma, D., Moll‐Murata, C., & van Zanden, J. L. (2011). Wages, prices, and living standards in China, 1738–1925: in comparison with Europe, Japan, and India. The Economic History Review, 64(s1), 8–38. https://doi.org/10.1111/j.1468-0289.2010.00515.x

Ambrière, F. (1932). La Vie secrète des grands magasins. Les Oeuvres Françaises.

AMR Corporation. (1987). The Art of Managing Yield American Airlines Annual Report 1987.

Appel, J. H. (1930). The Business Biography of John Wanamaker: Founder and Builder, America’s Merchant Pioneer from 1861 to 1922. MacMillan.

Austin, D. (2011). Doing Business as a Christian in Early Twentieth Century China. In “Kingdom-Minded” People (Vol. 49, Issue 04, pp. 71–105). BRILL. https://doi.org/10.1163/9789004222670_006

Barth, G. (1982). City People: The Rise of Modern City Culture in Nineteenth-Century America. Oxford University Press.

Basu, D., & Miroshnik, V. (2021a). Ethics, Morality and Business: The Development of Modern Economic Systems, Volume I. https://doi.org/10.1007/978-3-030-71493-2

———. (2021b). Ethics, Morality and Business: The Development of Modern Economic Systems, Volume II. Springer International Publishing. https://doi.org/10.1007/978-3-030-68067-1

Beauvais, J.-M. (2004). Urbanisme commercial et voiture particulière. Transports Urbains, 106(1), 18. https://doi.org/10.3917/turb.106.0018

Beckmann, M. J., & Bobkoski, F. (1958). Airline demand: An analysis of some frequency distributions. Naval Research Logistics Quarterly, 5(1), 43–51. https://doi.org/10.1002/nav.3800050105

Ben-Khedher, N., Kintanar, J., Queille, C., & Stripling, W. (1998). Schedule Optimization at SNCF: From Conception to Day of Departure. Interfaces, 28(1), 6–23. https://doi.org/10.1287/inte.28.1.6

Bin Ahmad Alserhan, B. (2009). Propensity to bargain in marketing exchange situations:a comparative study. European Journal of Marketing, 43(3/4), 350–363. https://doi.org/10.1108/03090560910935460

Bolton, L. E., Keh, H. T., & Alba, J. W. (2010). How Do Price Fairness Perceptions Differ across Culture? Journal of Marketing Research, 47(3), 564–576. https://doi.org/10.1509/jmkr.47.3.564

Brandt, L., Ma, D., & Rawski, T. G. (2014). From Divergence to Convergence: Reevaluating the History Behind China’s Economic Boom. Journal of Economic Literature, 52(1), 45–123. https://doi.org/10.1257/jel.52.1.45

Braudel, F., & Labrousse, E. (1970). Histoire économique et sociale de la France, vol. 4, L’ère industrielle et la société d’aujourd’hui (siècle 1880-1980). Presses Universitaires de France.

Brockett, L. P. (1868). Men of Our Day, Or, Biographical Sketches of Patriots, Orators, Statesmen, Generals, Reformers, Financiers and Merchants. Zeigler, McCurdy & Company.

Bugalia, N., Maemura, Y., & Ozawa, K. (2021). Demand risk management of private High-Speed Rail operators: A review of experiences in Japan and Taiwan. Transport Policy, 113(December 2019), 67–76. https://doi.org/10.1016/j.tranpol.2019.12.004

Casson, L. (1974). Travel in the Ancient World. Hakker.

Casson, M., & Casson, C. (2014). The history of entrepreneurship: Medieval origins of a modern phenomenon. Business History, 56(8), 1223–1242. https://doi.org/10.1080/00076791.2013.867330

Chan, W. K. K. (1996). Personal Styles, Cultural Values and Management: The Sincere and Wing on Companies in Shanghai and Hong Kong, 1900–1941. Business History Review, 70(2), 141–166. https://doi.org/10.2307/3116879

———. (2010). Chinese Entrepreneurship since Its Late Imperial Period. In D. S. Landes, J. Mokyr, & W. J. Baumol (Eds.), The Invention of Enterprise (pp. 469–500). Princeton University Press. https://doi.org/10.1515/9781400833580-020

Chao, L., & Hsiang, C. (1969). The Objective Basis of Differential Prices of Commodities and the Basis Of Enacting Differential Prices Under the Socialist System. Chinese Economic Studies, 3(2), 119–145. https://doi.org/10.2753/CES1097-14750302119

Chen, X., Simchi-Levi, D., & Wang, Y. (2022). Privacy-Preserving Dynamic Personalized Pricing with Demand Learning. Management Science, 68(7), 4878–4898. https://doi.org/10.1287/mnsc.2021.4129

Choe, P., & Wu, J. (2015). Customer perceptions toward dynamic pricing for wireless data service. International Journal of Mobile Communications, 13(2), 172. [https://doi.org/10.1504/IJMC.2015.067962](https://doi.org/10.1504/IJMC.2015.067962

Clifford, N. R. (1991). Spoilt Children of Empire: Westerners in Shanghai and the Chinese Revolution of the 1920s. Middlebury.

Crandall, R. L. (2022). Robert L. Crandall WG60. Life Lessons: Reflections of an Airline Industry Legend - Wharton Magazine. Wharton Magazine.

Cross, R. G. (1997). Revenue management: hard-core tactics for market domination. Broadway Books.

Cross, R. G., Higbie, J. A., & Cross, D. Q. (2009). Revenue Management’s Renaissance. Cornell Hospitality Quarterly, 50(1), 56–81. https://doi.org/10.1177/1938965508328716